Kenya has received a $750 million (Sh85.8 billion) loan from the World Bank to support its budget and drive fiscal, power, water and land reforms even as the costs on Eurobond double.

The loan is the second tranche granted to the country after World Bank wired a similar amount in June last year under the Development Policy Operation (DPO) programme, which lends cash for budget support instead of financing specific projects.

The World Bank said the concessional loan will have a 3 percent annual interest rate with $520 million lent through the International Development Association (IDA), having a 30-year maturity with a five-year grace period and $230 million through the International Bank for Reconstruction and Development’s (IBRD) with an 18.5-year maturity and a five-year grace period.

The funds are meant to help the economy recover from the effects of the Covid-19 pandemic by strengthening fiscal management, driving efficiency in the power sector as well as achieving environmental, land, water and healthcare reforms.

This comes as yields on the bonds, which have a maturity profile of between two and 26 years, have gone up by an average of 3.34 percentage points since June 2021. The highest rise has been on the seven-year paper maturing in 2027, which has nearly doubled from 4.8 percent to 9.17 percent.

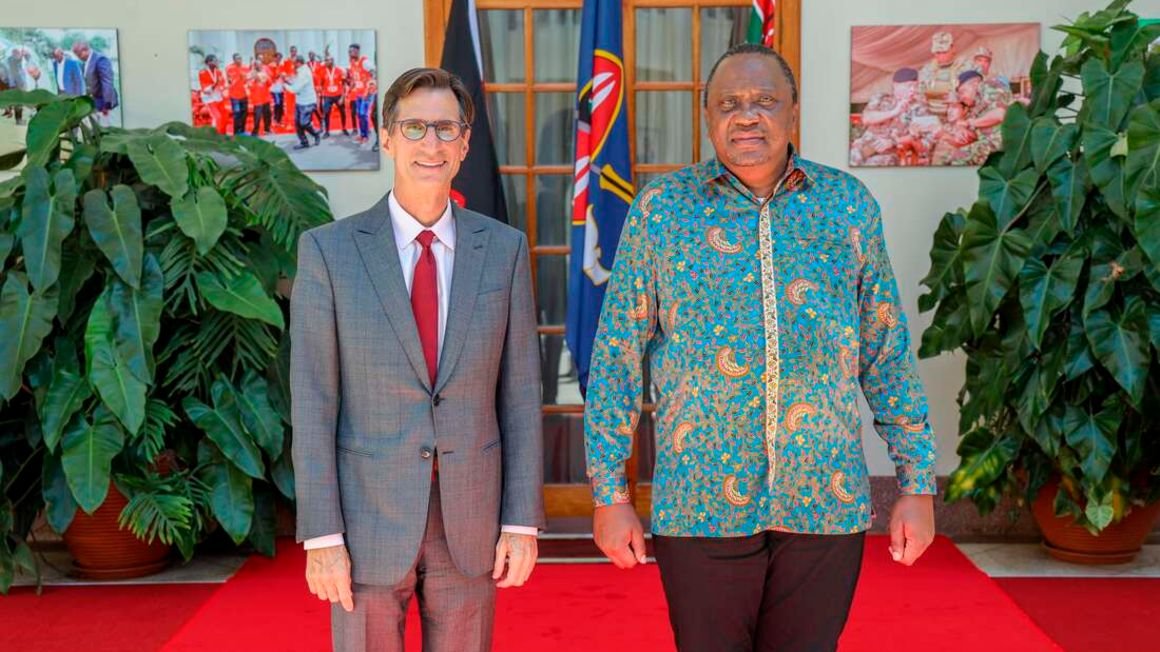

“This funding is the second in a two-part series of development policy operations initiated in 2021. The total annual interest cost of the Kenya DPO is approximately 3.0per cent,” said Alex Sienaert, senior economist for the World Bank in Kenya.

The bank said some of the funds would go towards setting up an electronic procurement system for government goods and services to improve transparency.

Mr Sienaert said by the end of 2023, the program aims to have five strategically selected ministries, departments, and agencies, procuring all goods and services through the electronic procurement platform.