Since the launch of M-Shwari in 2012, the number of digital lenders and loans disbursed has grown substantially. Advances in credit scoring, few regulatory barriers, and the widespread use of mobile phones and mobile money have enabled the growth of the digital lending industry, giving borrowers a quick and convenient option for credit.

According to the Communication Authority of Kenya’s latest report, mobile money subscriptions grew to 36.4 million from 35.2 million in the previous quarter under review, as a result of greater diversification of value proportions by service providers.

“Mobile money now plays a critical role in deepening financial inclusion for the underserved and most vulnerable groups, particularly women. The period saw KSh. 1.2 trillion deposited in mobile wallets with KSh.1.3 trillion used in payment of goods and services. At the same time, KSh.13 million was transacted as payment for government services,” the report reads.

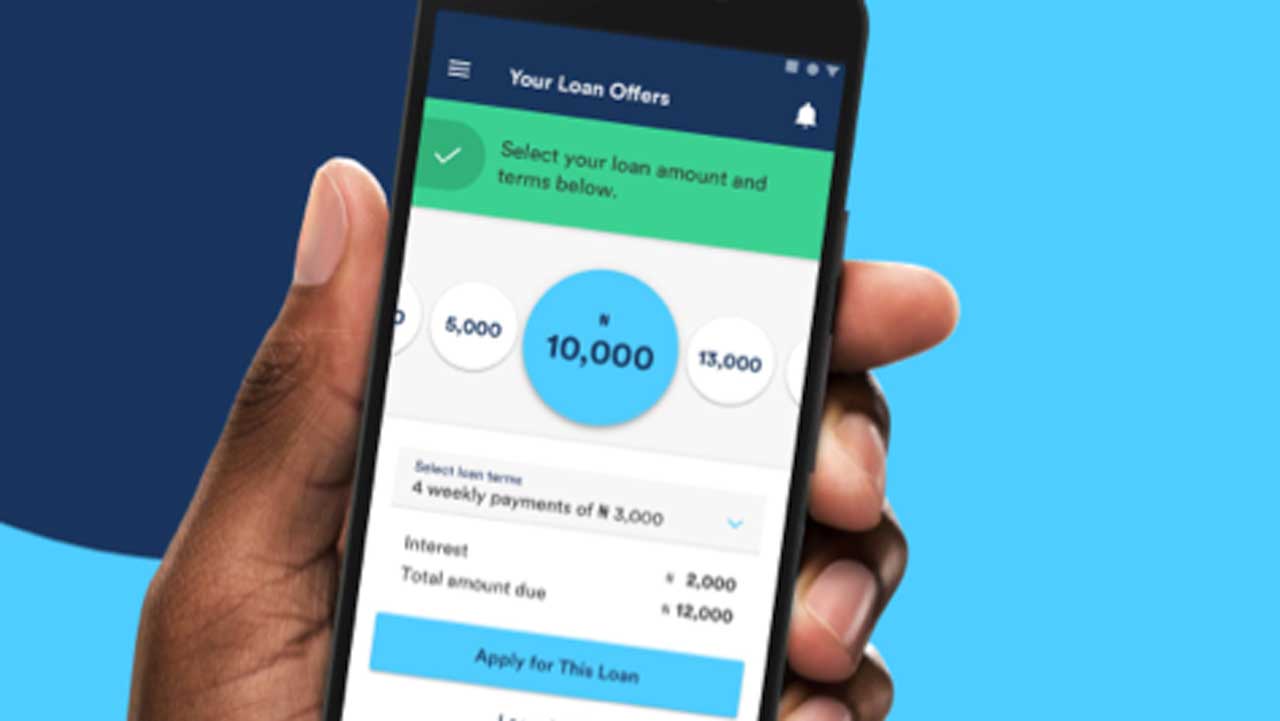

There is no doubt that the new digital technologies are innovating financial services for people and businesses faster, cheaper, and more conveniently than ever before, this is expanding access to financial services to previously unbanked and underserved populations at a remarkable rate.

These technologies allow service providers to offer a wider range of services with greater reach, and to improve their own efficiency and lower operating costs.

Slow or fast, however, the rapid growth of online platforms makes the digital financial service industry and its customers uniquely vulnerable. Consumers turning to digital lenders are more likely to spend beyond their means, sink further into debt, and ultimately default more often than people with similar credit profiles borrowing from traditional banks.

Digital lending looks like a savior to many but ideally it is sinking the majority of low-and-middle-income earners into the pit hole of debt.

To understand why people fall victim to digital borrowing without an end, I spoke to a 36-year-old, father of 2, who said,

“First, digital credit is instant; this means that the time span between application and approval is typically less than half an hour, so that whets my appetite. Unfortunately, I have found myself, a victim, I can’t live without borrowing because every end month I repay my debt and borrow again to keep me going, my daily hustle is also not doing well.”

Another victim says, “I have suicidal thoughts, I am deep in debt, already listed with CRB, and not able to make ends meet.”

While it is an increasingly prominent source of borrowing, it is also turning out as the leading debt trap. Economists say it is high time we asked ourselves and addressed these questions:

- Why the sudden rise in digital borrowing among the youth?

- The Impact of a debt-burdened economy, and the need to slow down digital borrowing in Kenya.

Reginald Kadzutsu, the Chief Executive Officer at Amana Capital limited says the digital credit is built on the infrastructure of mobile money, by enabling mobile phone users to transfer money across mobile networks Worldwide, however, the growth in the sector has exposed millions of mobile money users to eazy loans.

“The economy has failed to create enough jobs for a predominately youthful population hence the sudden rise in digital borrowing,” He says.

Reginald is an investment and economic professional who has spent the last 12 years finding, analyzing, and implementing retail solutions to grow financial inclusion. Having spent time analyzing the Kenyan market, he says the digital lending space needs urgent regulation and improvement in information sharing, “The space is unregulated and we see people who should not be getting loans get them and not able to repay, this crowds out the real borrowers that need access to these quick funds especially the MSME for quick working capital.”

The credit approval of digital lending is an automated process, which is undertaken by algorithms, based on non-traditional data such as mobile money or phone usage data and again the process is remote, meaning the borrower has the possibility of accessing digital credit from wherever when they have the access to the mobile network.

“Debt burden of the population is a chain that ties one to poverty because most of these debts are for consumption hence people are in perpetual borrowing cycle and just one crisis away from poverty.” Reginald continues to say, “This pitfall steals away productivity and innovation, and reduces future savings capacity for an economy.”

Whereas the short repayment periods and small-loan sizes render digital credit in its typical form unsuitable for long-term investments those who are trapped in this vicious circle of over-borrowing use the loans for unproductive expenditures like sports betting…creating an equal circle of debt repayments.

The lack of typical contract enforcement mechanisms for digital lenders makes the matter even worse.

“The negative reporting to a credit reference bureau (CRB), and high blacklisting is because of the high default rate which is a case of digital lending, however, there needs to be a mechanism to allow for information sharing. If the industry can reduce information asymmetry we could see more quality loans at a cheaper cost.” Reginald Kadzutsu.

This high default rate is creating an environment of more risky borrowers.

(Translated) “I am currently excluded from accessing loans due to blacklisting. I took a loan with one of the mobile lending app and I couldn’t pay on time. I am not able even today to repay because I am literally living hand to mouth, though I plan to repay it in the near future.” Susan, a vegetable vendor

Stories like that of Susan can become severe obstacles to sustainable credit access for many borrowers, in fact, many of those who take up digital loans have characteristics that make them less likely to have access to the conventional formal credit market.

As a country, Reginald Kadzutsu advises that loans should not be used to finance consumption because one is likely to end up overspending or overstretching themselves, and then more likely to be in default which will cut them out of the credit market altogether.

If you are already in “bad debt”, you need to start digging yourself out before it negatively affects your life and ruin trust. Organize all your debts and bills and start to pay one shilling at a time.